At the Analyst level base pay is a discount to base pay in equity research which in turn is a discount to investment banking salaries. ツ ツ ツ The correlation between the fund returns is 01065.

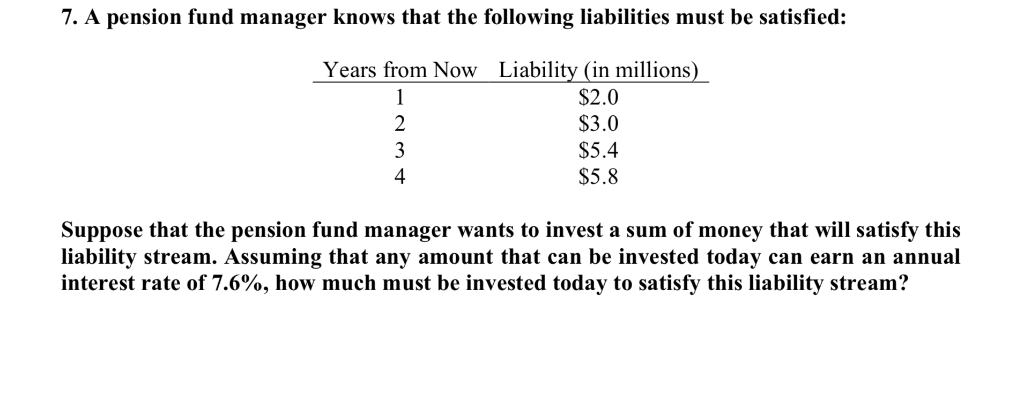

Solved 7 A Pension Fund Manager Knows That The Following Chegg Com

A form of pension plan in which the participant has some ability to determine how pension contributions are invested is described as an.

. Plus market value of debt and preferred stock minus short-term investments. Both b and c of. Which of the following can be described as involving direct finance.

Business Finance QA Library Neko Inc. Explain how the IR measures portfolio performance and whether this analogy is appropriate. A corporation buys commercial paper issued by another corporation.

Minus market value of debt preferred stock and short-term investments. 2 PROBLEMS Problem 1 The last years performance for four mutual funds is presented below. If the company had forecast its additional financing needed to be 2340000 its capital budget at 3600000 and net income at 1800000 what is its retention ratio.

Stakeholder theory is best described as being based on the presumption that the corporation has direct concerns about its relationship with a The corporate regulator b The QA The corporate collapses of the early 2000s and those that occurred during the Global Financial Crisis had some important common themes that we must understand if as. The probability distribution of. In this direction we let the fund manager question the validity of the reference probability measure P the above problem is considered under the probability measure Q which reflects the fund managers idea about the evolution of the future states of the world that is 7 sup π b A F E Q U ε Y T A F t where Y.

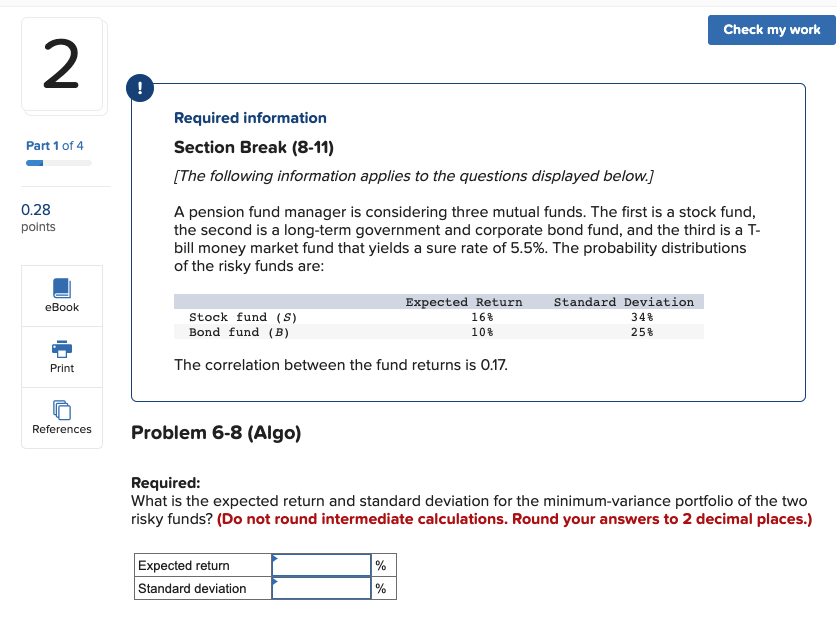

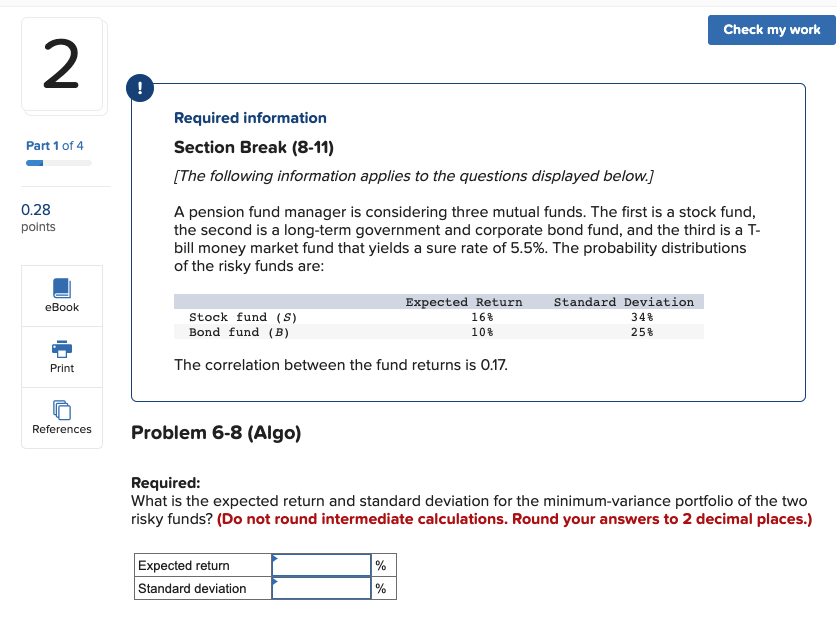

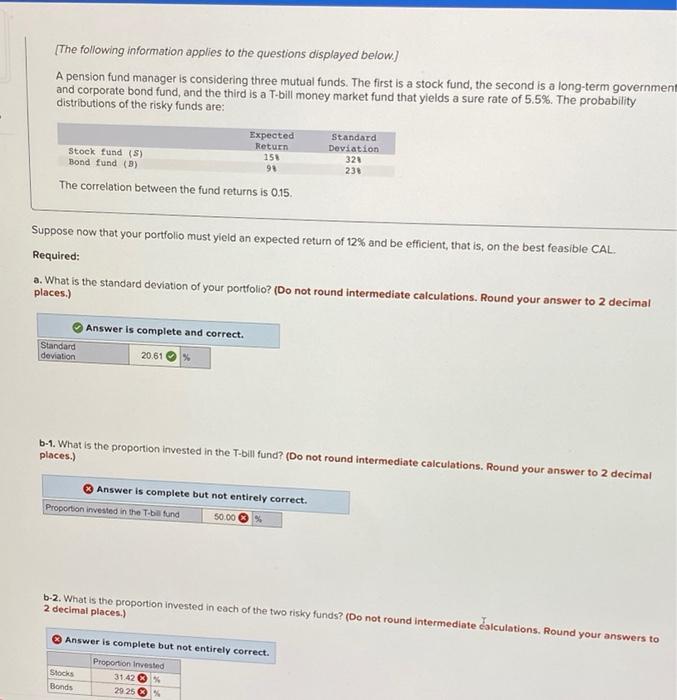

Decide among the following investment options for your fund. A pension fund manager is considering three mutual funds. A defined contribution plan b endowment plan c defined benefit plan 19.

A pension fund manager wants to protect the funds diversified stock portfolio against a market downturn. A retired senior management official of the company A representative of a pension fund that owns 10 of the companys shares A former government employee who was involved in regulating the industry Based on good corporate governance practices which candidate is the most appropriate nominee. The first is a stock fund the second is a long-term government and corporate bond fund and the third is a T-bill money market fund that yields a rate of 30.

We show that this framework allows one to flexibly model many features of the pension fund management problem. To best meet this objective she should purchase. Uses Additional Funds Needed as a plug item.

A Manager 1 B Manager 2 C Manager 3. Selecting Best Pension Fund Manager To Invest In NPS. PE fund of fund structures introduce additional layers of costs that include management fees and performance fees paid to the top-level manager.

A fund manager is responsible for implementing a funds investment strategy and managing its trading activities. The Susquehana Industries pension fund value and growth portfolio managers follow a sell discipline that is best described as. A corporations stock is traded in an over-the-counter market.

This preview shows page 1 - 3 out of 5 pages. For our Dutch clients in 2012 and 2013 total PE fund of fund costs were 5042 This means that fund of fund investors on average paid 122 more than direct LP investors due to these additional costs. The probability distributions of the risky funds are.

30 The Susquehanna Industries pension fund value and growth portfolio managers from FINANCE MISC at McMaster University. They oversee mutual funds or pensions manage analysts conduct research and make. Minus market value of debt and preferred stock plus short-term investments.

A pension fund manager is considering three mutual funds. The first is a stock fund the second is a long-term government and corporate bond fund and the third is a T-bill money market fund that yields a sure rate of 47. Three equity fund managers have performance records summarized in the following table.

While the NPS rules allow subscribers to have different pension fund managers for their Tier 1 and Tier 2 accounts the rules do not permit subscribers to choose different fund managers for different schemes within the same tier. Question 5 The Information ratio IR has been described as a benefit-to-cost ratio. An investor attempting to replicate a.

You are a pension fund manager looking for an investment that will provide a reliable stream of income over the next 5 years. The market value of equity for a company can be calculated as enterprise value. Mean Annual Return Standard Deviation of Return Manager 1 1438 1053 Manager 2 925 635 Manager 3 1310 823 Given a risk-free rate of return of 260 which manager performed best based on the Sharpe ratio.

A pension fund manager buys commercial paper from the issuing corporation. The usual hierarchy in pension fund investment management is Investment Analyst Investment Officer Senior Investment Officer Portfolio Manager Program Director and Chief Investment Officer CIO. Call Options on the stocks in the portfolio C.

Puts on a comparable index B. Transcribed image text. Calls on a comparable index.

You want to find the best yield possible while still conforming to the pension fund covenant of investing in investment grade bonds or better. The pension fund representative. Our approach is a computationally tractable alternative to the stochastic programming-based approaches.

Covered puts on the stocks in the portfolio D. Both a and b of the above. A retired senior management official of the company A representative of a pension fund that owns 10 of the companys shares A former government employee who was involved in regulating the industry Based on good corporate governance practices which candidate is the most appropriate nominee.

An investment opportunity set is best described as. The pension fund representative. Up to 10 cash back In this article we propose a robust optimization-based framework for defined benefit pension fund management.

Solved Check My Work 2 Part 1 Of 4 Required Information Chegg Com

Solved The Following Information Applies To The Questions Chegg Com

Solved Problem 7 4 A Pension Fund Manager Is Considering Chegg Com

0 Comments